Mother & Baby Haven

Your trusted resource for parenting tips, baby care, and mothering advice.

Insurance Smackdown: Finding Your Perfect Match

Discover the ultimate showdown in insurance! Uncover tips to find your perfect policy match and save big today!

Understanding Different Types of Insurance: Which One Is Right for You?

Insurance is a vital component of financial planning, offering protection against unforeseen events and providing peace of mind. There are various types of insurance, each designed to address specific risks and needs. The most common categories include health insurance, auto insurance, homeowners insurance, and life insurance. Understanding these options can help you make informed decisions tailored to your unique situation. For example, health insurance is essential for covering medical expenses, while auto insurance protects against vehicle-related accidents and liabilities.

When it comes to choosing the right insurance, it’s crucial to assess your individual circumstances and priorities. Consider factors such as your age, lifestyle, and financial goals. Ask yourself questions like:

- What risks am I most concerned about?

- How much can I afford to pay in premiums?

- What kind of coverage do I truly need?

Top 5 Factors to Consider When Choosing Your Insurance Provider

Choosing the right insurance provider is a critical decision that can significantly impact your financial security and peace of mind. Here are the top 5 factors to consider when making your choice:

- Coverage Options: Assess the range of policies available, including auto, home, health, and life insurance. Ensure the provider offers coverage that meets your specific needs.

- Financial Stability: Research the provider's financial strength and long-term stability. You want to select an insurer that can fulfill their claims obligations.

- Customer Service: Evaluate the quality of customer service. Look for reviews or ratings that highlight the experience of current policyholders.

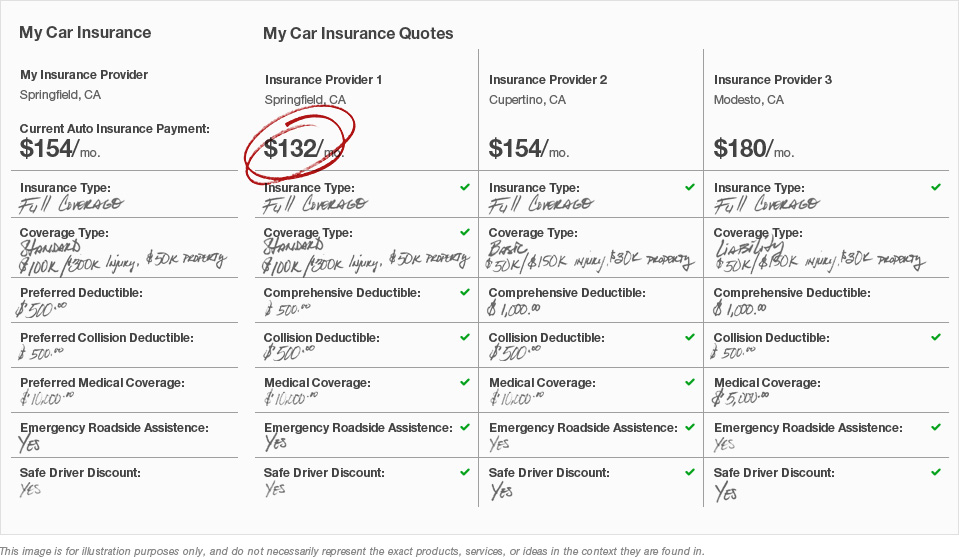

- Price: Compare premium rates among providers, but remember that the cheapest option may not always offer the best coverage.

- Claims Process: Investigate how easy it is to file a claim and the average turnaround time. A straightforward claims process can save you stress during difficult times.

Insurance Myths Debunked: What You Really Need to Know

When it comes to insurance, misconceptions abound that can lead to poor decisions. One common myth is that all insurance policies are the same. In reality, policies can vary significantly based on coverage limits, exclusions, and deductibles. It's essential to understand the specific terms of your policy instead of relying on generalized assumptions. For example, many people believe that their health insurance will cover all medical expenses, but this often isn't the case due to network restrictions or exclusions for certain treatments.

Another prevalent myth is that young drivers do not need car insurance or can get by with the minimum coverage. In truth, younger drivers are statistically more likely to be involved in accidents, making it crucial to have adequate coverage. Additionally, many believe that if their car is older, they can forgo collision coverage. However, this can leave you financially vulnerable if an accident occurs. Understanding these myths about insurance can help you make informed choices and ensure you have the appropriate protection.