Mother & Baby Haven

Your trusted resource for parenting tips, baby care, and mothering advice.

Catch These Hidden Auto Insurance Discounts

Unlock secret auto insurance discounts and save big! Don’t miss out on hidden savings that could lower your premium today!

Unlocking Savings: A Guide to Hidden Auto Insurance Discounts

Auto insurance can often feel like a significant monthly expense, but many drivers are unaware of the various ways they can save on their premiums. Hidden auto insurance discounts can significantly reduce your costs without sacrificing coverage. For instance, many insurers offer discounts for drivers who maintain a clean driving record, complete a defensive driving course, or bundle multiple policies. It's essential to ask your insurance provider about these opportunities, as they may not always be advertised. Additionally, factors such as your vehicle's safety features or mileage can qualify you for further savings.

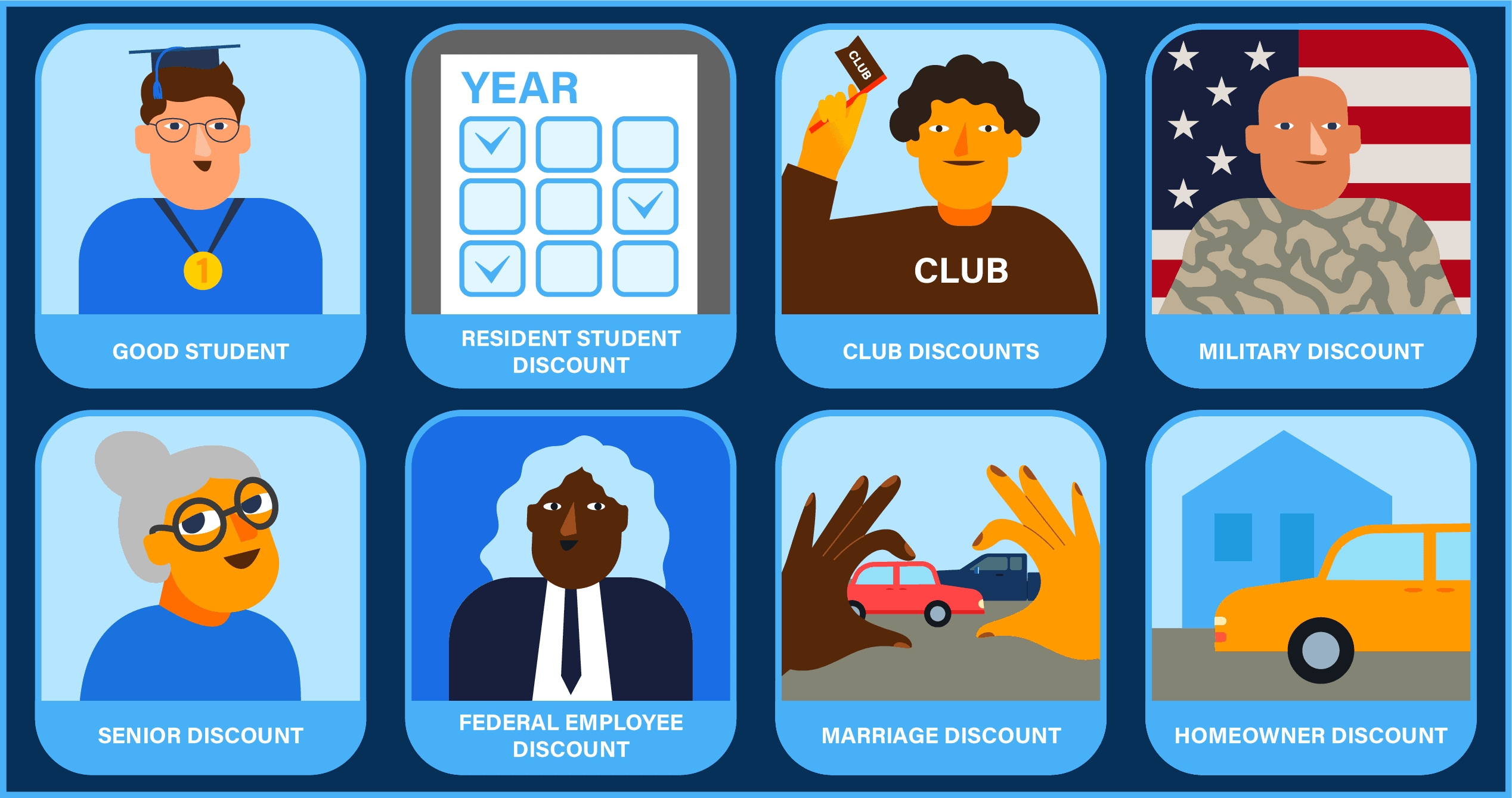

Another often-overlooked area for potential discounts is your membership in certain organizations. Many car insurance companies provide discounts to members of specific professional groups, alumni associations, or even large employers. Exploring these hidden auto insurance discounts could result in substantial savings. To maximize your benefits, consider reviewing your coverage annually and comparing quotes from multiple insurers. This proactive approach ensures you're taking full advantage of available discounts and helps you unlock the best possible rates for your auto insurance.

Are You Missing Out? Discover Secret Auto Insurance Discounts Today

Are you tired of overpaying for auto insurance? Auto insurance discounts are often hidden in the fine print, and many drivers may not even be aware that they qualify for them. From safe driving records to bundling policies, the opportunities are vast and varied. Being proactive about discovering these discounts can save you a considerable amount on your premium. Here are a few common discounts you might be missing out on:

- **Safe Driver Discounts**

- **Multi-Policy Discounts for Bundling**

- **Low Mileage Discounts**

- **Good Student Discounts**

Additionally, **discounts for newer vehicles** or features like anti-theft systems are often overlooked. Many insurance companies reward those who take proactive measures to protect their cars. Another important factor is your credit score; maintaining a healthy score can also qualify you for better rates. Inquire with your provider about any special promotions or loyalty rewards. Don't leave money on the table; it’s time to discover hidden auto insurance discounts and ensure you’re getting the best deal possible!

Maximize Your Coverage: Insider Tips for Finding Auto Insurance Discounts

Finding the right auto insurance coverage can be a daunting task, but knowing where to look for auto insurance discounts can make a significant difference in your premiums. Start by reaching out to your current insurance provider and asking about any available discounts. Many companies offer discounts based on factors such as safe driving records, bundling policies, or even being a member of certain organizations. Additionally, consider taking a defensive driving course, which not only sharpens your skills but can also lead to substantial savings on your policy.

Don’t forget to shop around and compare rates from multiple insurers. Online tools make it easier than ever to get quotes and see which companies provide the best discounts on auto insurance. Make a list of potential discounts offered by each insurer and review them carefully. Look for perks like loyalty rewards for long-term customers or lower rates for low mileage drivers. By leveraging these insider tips, you can maximize your coverage while significantly reducing your costs.