Mother & Baby Haven

Your trusted resource for parenting tips, baby care, and mothering advice.

Term Life Insurance: The Safety Net You Didn't Know You Needed

Discover the hidden benefits of term life insurance and why it’s the safety net you never knew you needed for financial peace of mind!

Understanding the Basics of Term Life Insurance: Is It Right for You?

Term life insurance is a type of life insurance policy that provides coverage for a specified period, or 'term,' usually ranging from 10 to 30 years. The primary purpose of term life insurance is to provide financial protection for your loved ones in the event of your untimely death during the policy term. If the policyholder passes away while the policy is active, the beneficiaries receive a death benefit, which can be used to cover expenses such as mortgage payments, education costs, or daily living expenses. One significant advantage of term life insurance is its affordability; it typically offers higher coverage amounts at lower premiums compared to permanent life insurance options.

When considering whether term life insurance is right for you, it’s essential to assess your financial situation and future needs. Ask yourself the following questions:

- Do you have dependents who rely on your income?

- What financial obligations do you need to cover in case of your death?

- How long do you expect those obligations to last?

How Term Life Insurance Can Protect Your Family's Financial Future

Term life insurance is a crucial financial tool that can provide your family with peace of mind and security. Unlike permanent life insurance, term life policies offer coverage for a specified period, typically ranging from 10 to 30 years. This duration allows you to choose a policy that aligns with your family's financial needs, ensuring that in the event of your untimely passing, they are shielded from the financial burdens associated with loss of income, mortgage payments, and daily expenses. By selecting the appropriate coverage amount, you can effectively safeguard your loved ones' future and preserve their standard of living.

In addition to covering immediate expenses, term life insurance can serve as a vital component in long-term financial planning. Should the unexpected occur, the death benefit can be used to fund important goals such as your children’s education or retirement savings for your spouse. This flexibility ensures that your family's financial future remains intact during challenging times. By investing in term life insurance, you not only secure a safety net for your family but also demonstrate a commitment to their well-being and stability, fostering a sense of security that is invaluable in today’s unpredictable world.

5 Common Myths About Term Life Insurance Debunked

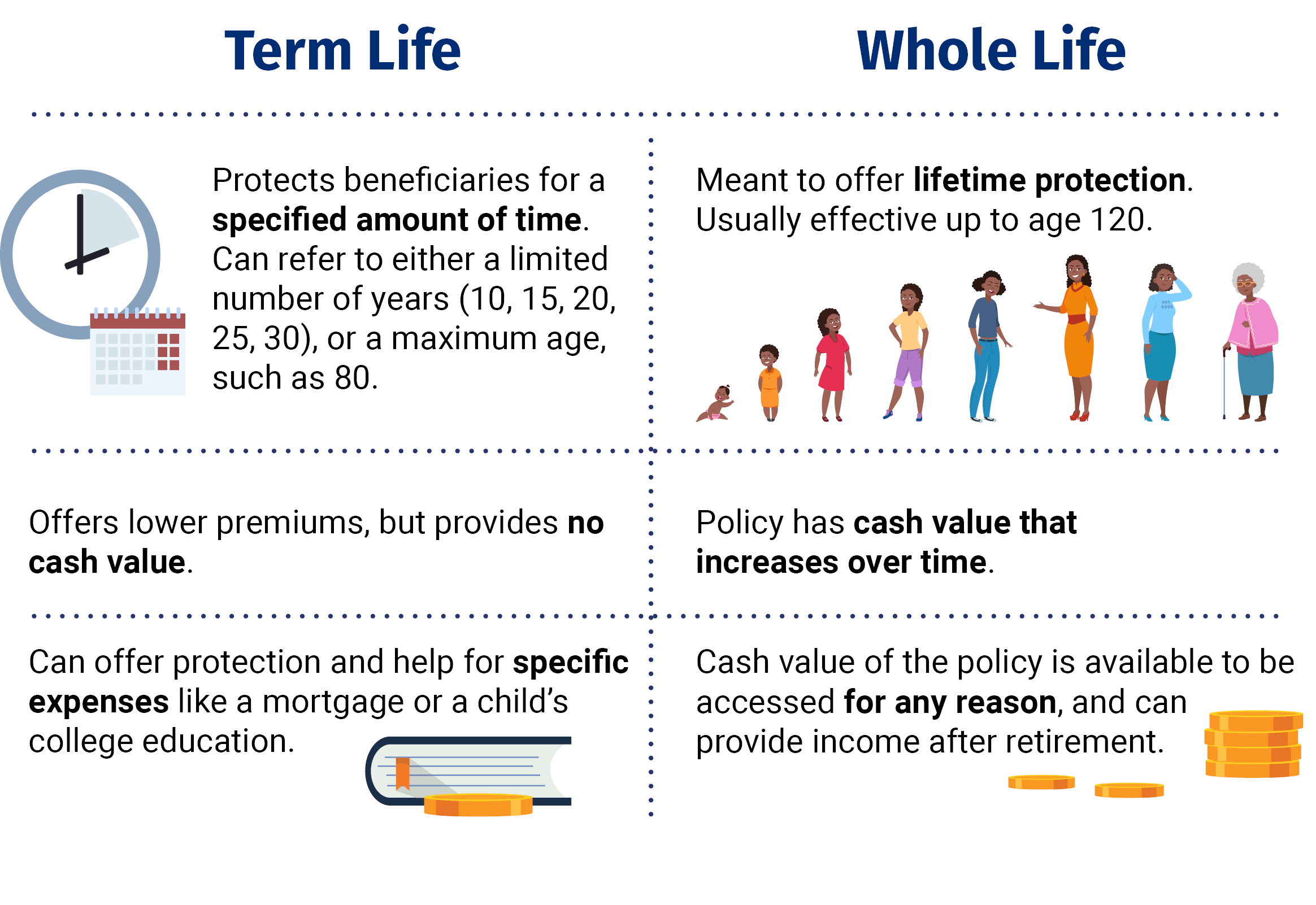

Term life insurance is often misunderstood, leading to a variety of myths that can prevent people from making informed decisions. One common myth is that term life insurance is only beneficial for young people. In reality, anyone can benefit from term life insurance at any age, as it provides essential financial protection for dependents in the event of an untimely death. Additionally, many believe that term life insurance doesn’t have any value. However, while it does not accumulate cash value like whole life insurance, it serves its primary purpose of providing a death benefit during the coverage period.

Another pervasive myth is that term life insurance is too expensive. In fact, term policies are often one of the most affordable types of coverage available, especially for young and healthy individuals. Furthermore, some people think they won’t qualify for a term policy due to health issues, but many companies offer options for those with pre-existing conditions. Ultimately, it’s important to challenge these myths and understand that term life insurance can be a sensible and cost-effective choice for protecting your loved ones' financial future.